I am seeing dozens of cases where families are using AI to fight institutional power, but we've had no systematic resources to help us. Until now. These principles + prompts help you fight back!

Nate

This is a post about what happens when institutions try to screw you, and you fight back with AI.

It’s a post inspired by a real story about a family using Claude to save $160,000 in medical expenses.

I wish that was unusual, but I’m seeing lots of examples of AI being used to help families in impossibly adversarial situations. Situations where institutions count on you being confused.

Where every maze you can’t navigate is money in somebody’s pocket.

I’m writing this because people I know are fighting battles they shouldn’t have to fight alone. A friend of mine is navigating special education bureaucracy right now. I have friends and family facing medical bills that seem unfair, and that are hidden behind billing jargon.

And everyone I know has family or friends in a similar boat.

Institutions are everywhere in our lives, and they make money off complexity.

The thing is: AI kills complexity. It’s designed to be the perfect leveler, enabling YOU to fight back.

Because these aren’t edge cases. This is how the system works. Hospitals maintain dual pricing systems—chargemaster rates for people who don’t know better versus negotiated rates for those who do.

Insurance companies bury exclusions in appendices using policy language most people can’t parse.

Funeral homes rotate inventory so you can’t comparison shop while grieving. The information asymmetry isn’t accidental. It’s the business model.

AI changes the economics of fighting back. Not by giving you advice—by giving you investigative capacity at institutional scale. You can now decode technical documents, audit compliance against regulatory frameworks, identify categorical violations, and draft correspondence that signals sophistication. Investigation that used to cost thousands in professional fees now costs hours of your time.

But most people don’t know this capability exists yet. They’re still using AI to ask “what should I do?” instead of “what evidence exists that they violated documented standards?” That’s the difference between getting a sympathetic response and getting a $160,000 billing adjustment.

This post is all about leveling that playing field. I lay out 10 principles (8 in the video, plus 2 bonus ones in the post), and put it all together with 7 prompts to designed to enable you to drive a real investigation into a institution you suspect is taking advantage of you.

The article below teaches ten principles for fighting institutional power asymmetry:

- Why investigation beats negotiation every time - How to find leverage before they know you have it

- How AI decodes the jargon they use as a weapon - Turn 200 pages of Medicare rules into plain English in minutes

- Where to find the rulebook they’re betting you can’t read - Every domain has regulations; most people never look them up

- How violations hide between documents - Cross-reference multiple sources to catch what single-document review misses

- Why “seems expensive” loses and categorical violations win - The difference between complaints they ignore and violations they can’t defend

- How to anchor your position in numbers they can’t argue with - Use their own published standards against them

- Why verification separates investigation from guessing - Spot-check findings and fact-check citations before you stake credibility

- How to signal you understand the game - Match institutional register so they know you’re a threat

- Why their framing is designed to put you on defense - Control the frame or lose before you start

- How responses tell you whether you’re winning - Read their reaction as intelligence about your position strength

Plus a prompt pack with seven prompts that operationalize those principles:

- Framework Finder - Discover which regulations govern your fight (and why they’re hiding them)

- Violation Auditor - Find the categorical violations buried in technical language

- Benchmark Calculator - Extract the authoritative numbers that establish what you should actually pay

- Verification Protocol - Catch AI errors before they become self-inflicted wounds

- Dispute Letter Generator - Draft correspondence that signals you know exactly what you’re doing

- Response Decoder - Read their reaction to know whether to press harder or take the win

- Self-Advocacy Assessment - Decide if you can win this yourself or need professional firepower

These prompts don’t replace judgment about ambiguous law, don’t handle complex procedure, and don’t make lawyers unnecessary.

What they do: collapse investigative costs from thousands of dollars to hours of your time, let you verify findings yourself instead of trusting blindly, and change how you think about when professional help matters most.

My goal here is simple: I want to socialize the specific skills that make it easy for people to actually leverage AI. I want to give you a sense of the specific AI usage patterns that help people fight back against the systems that have used information complexity for centuries to keep people in the dark.

Good luck out there! Don’t let the system win just because it knows more.

Subscribers get all these newsletters!

Subscribed

Grab the Adversarial Prompt Pack

These seven prompts give you the complete investigation workflow for fighting institutional power asymmetry. They let you identify which rules govern your situation, audit for categorical violations against those rules, calculate what authoritative standards say the answer should be, verify your findings before you stake credibility on them, draft professional correspondence that signals sophistication, read institutional responses diagnostically, and triage whether you’re in self-advocacy territory or need professional help.

What they don’t do: replace judgment about ambiguous law, handle complex procedure, or make lawyers unnecessary.

What they do: collapse the cost of institutional-level investigation from thousands of dollars to hours of your time, let you verify findings yourself instead of trusting blindly, and change when you need professional help from “to investigate” to “to litigate.”

Good luck!

Adversarial Prompting: Using AI When Someone Is Trying to Screw You

=====================================================================

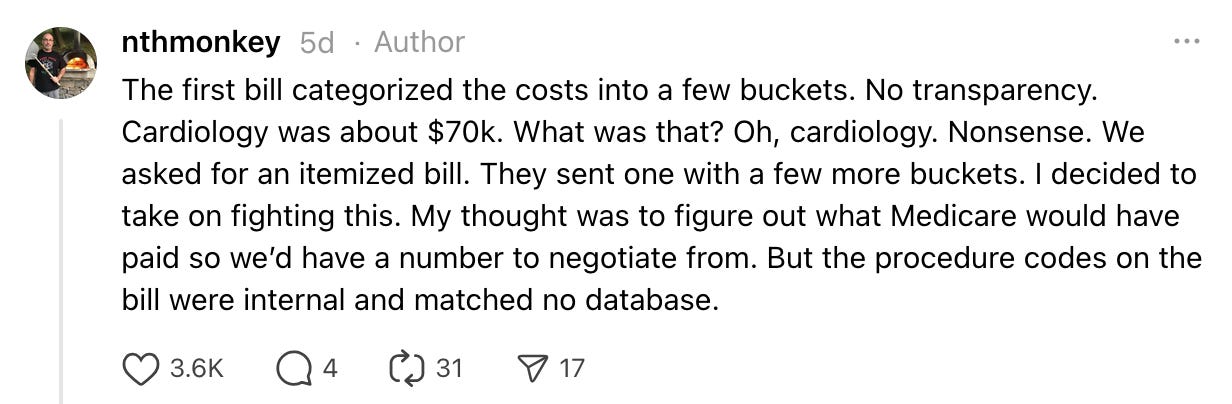

A man died of a heart attack in June. Four hours in the hospital, $195,000 in bills. His brother-in-law used Claude to negotiate that down to $32,500 by identifying $162,000 in Medicare billing violations the hospital couldn’t defend. The investigation took about three hours.

This isn’t a story about one lucky family with medical billing expertise. The brother-in-law’s background was writing, not healthcare. What he understood was how to conduct adversarial investigation when you’re outgunned—and how AI fundamentally changes the economics of fighting institutional power asymmetry. Grab the full story on Threads here.

Complexity is the product, not the side effect

Institutions don’t accidentally make things confusing. They construct information asymmetry deliberately because it enables price discrimination.

Hospitals maintain dual pricing systems. The chargemaster—list prices for self-pay patients running 5-10x Medicare rates—versus negotiated rates with insurers that reflect something closer to actual costs. The complexity isn’t a bug. It’s how they charge different prices to different people based not on cost but on the customer’s ability to navigate their system.

The pattern repeats everywhere institutions extract wealth from individuals:

Funeral homes rotate casket inventory so you can’t comparison shop between visits. They markup wholesale costs 300-500% and count on families making decisions in 48 hours while grieving.

Debt collectors buy portfolios of time-barred debts for pennies on the dollar and collect from people who don’t know statute of limitations makes those debts legally uncollectible.

School districts use procedural complexity in special education law to delay evaluations past IDEA-required timelines, betting parents don’t know the rules.

Insurance companies bury exclusions in appendices and deny claims using policy language most people can’t parse, counting on you not understanding what “reasonable and customary” actually means in your state.

The information asymmetry isn’t a side effect of institutional complexity. It’s the mechanism that enables extraction. They profit from you not knowing what you don’t know.

AI doesn’t just give you answers. It gives you investigative capacity at institutional scale. But only if you understand you’re conducting an investigation, not asking for advice.

Principle 1: Investigation precedes negotiation

Most people approach institutional disputes by asking “what should I do about this?” That’s the wrong question. The right question is “what evidence exists that they violated documented standards?”

You can’t negotiate from strength without leverage. Leverage comes from documented violations of the frameworks that govern their industry. Investigation finds those violations. Only then do you negotiate.

The hospital bill started with “Cardiology: $70,000” on the first invoice. Opaque category, no detail. The brother-in-law didn’t argue it seemed high. He requested the itemized bill with CPT codes—the standardized procedural codes Medicare uses for billing. The hospital claimed their computer system wasn’t working. He asked again. Eventually they produced it.

This is investigation, not negotiation. He needed the bill in a format he could audit against regulatory standards. You can’t argue with “cardiology.” You can argue with specific CPT codes billed in violation of Medicare bundling rules.

Debt collection callout: You receive a collection notice for a 7-year-old debt. The letter threatens legal action and claims you owe $3,400. Most people either pay or ignore it. Investigation asks different questions: What’s the statute of limitations for this debt type in my state? When was the date of last activity? Did this letter contain FDCPA violations? You’re not negotiating whether you owe the debt. You’re investigating whether it’s legally collectible and whether their collection tactics violated federal law.

Insurance denial callout: Your claim gets denied with reason code “not medically necessary.” You could appeal saying “but my doctor ordered it.” Or you could investigate: What does your policy actually say about medical necessity? What’s the clinical evidence standard in your state? Did they follow your state’s required external review process? Did they apply the wrong policy version? Investigation finds documented failures in their process before you ever write the appeal.

The shift is: don’t react to their framing. Investigate whether their position is defensible under the frameworks that govern them.

Principle 2: Use AI to decode technical language institutions use as a moat

Institutions construct documents to be unreadable. Medicare billing rules span hundreds of pages of CPT code definitions, bundling requirements, and setting restrictions. Insurance policies bury coverage exclusions in appendices using terms like “reasonable and customary” that have specific regulatory definitions. FDCPA statutes reference other statutes which reference state laws. IDEA regulations cite case law that interprets vague phrases like “meaningful educational benefit.”

They’re betting you’ll be intimidated by the jargon and won’t read the actual rules. They’re betting you don’t have time to parse 200 pages of Medicare guidelines to understand whether “E/M code 99285” can be billed separately from “procedure code 92960.”

AI isn’t intimidated by jargon. It was trained on this stuff.

The brother-in-law didn’t understand Medicare billing rules when he started. He asked Claude: “Explain Medicare bundling requirements for these specific CPT codes in plain language. What are the rules about billing component procedures separately when a master procedure code is used?” Claude decoded the technical framework in minutes. It explained which codes bundle, what “incident-to” billing means, why setting matters for reimbursement rates.

This matters because you can’t audit compliance if you can’t understand the rulebook. The technical language is the first barrier. Remove it.

Medical billing callout: Your itemized bill shows CPT code 99285 (Emergency Department Visit, High Complexity) alongside detailed cardiovascular procedure codes. You don’t know what those numbers mean. Ask Claude: “What does CPT code 99285 cover? What procedures are typically bundled under it? Are there CMS rules about billing E/M codes separately from procedures performed during the same encounter?” Claude will decode the technical framework. You’ll learn that 99285 is an evaluation and management code that often can’t be billed separately when procedures are performed—exactly the kind of violation that hides in technical language.

Insurance policy callout: Your policy says treatments must be “medically necessary as determined by generally accepted medical standards.” That sounds clear until your claim gets denied. Ask Claude: “What does ‘medically necessary’ mean according to [your state] insurance regulations? What evidence standards do carriers have to follow? What are ‘generally accepted medical standards’?” Claude will explain that your state likely requires carriers to use evidence-based clinical guidelines, cite specific guidelines for your condition, and show you what the policy language actually obligates them to do. The vague language becomes concrete requirements you can audit against.

Debt collection callout: You receive a collection notice that references “validation rights under 15 U.S.C. § 1692g.” You don’t know what that means or what rights you actually have. Ask Claude: “What is 15 U.S.C. § 1692g? What validation rights does FDCPA give me? What must a debt collector provide if I request validation? What are the timeframes?” Claude decodes the statute. You’ll learn you can request validation within 30 days, collection must cease until they provide it, and what documentation they’re required to send. The legal citation becomes actionable knowledge.

The pattern: Institutions use technical language as a barrier. AI removes that barrier in minutes. You’re not becoming an expert—you’re getting expert-level decoding of the technical framework that governs your situation. That’s the first step. Once you understand the language, you can start checking whether they followed their own rules.

Principle 3: Every domain has a rulebook—find it first

Adversarial prompting doesn’t start with “how do I fight this?” It starts with “what technical framework governs this domain?”

Every industry has regulations, published standards, statutory requirements, or contractual terms that establish what they must do. Hospitals have Medicare billing rules. Debt collectors have FDCPA and state statutes of limitations. Funeral homes have FTC Funeral Rule requirements. Schools have IDEA procedural timelines. Insurance companies have state claims handling statutes and policy contract language.

Your first job: identify which framework applies. Your second job: get the documentation in the format that framework uses.

The hospital bill worked because the brother-in-law asked Claude something like: “What are the Medicare billing rules for these specific CPT codes? Are there bundling requirements, mutual exclusions, or setting requirements that would affect whether these can be billed together?”

He wasn’t asking “is this fair?” He was asking “what’s the technical rulebook?” Then he could audit the actual bill against that rulebook.

IEP negotiation callout: Your child’s school proposes 30 minutes of speech therapy per week. You could argue “that’s not enough.” Or you could identify the framework: IDEA requires a “free appropriate public education” with “meaningful educational benefit.” What did the school’s evaluation actually show? What services do comparable students receive in this district? What does case law say about meaningful benefit for this disability category? The framework is federal statute plus case law interpretation. Once you know the framework, you can audit whether their proposal meets it.

Property tax assessment callout: Your property tax bill jumps 40% after reassessment. You could complain it’s too high. Or you identify the framework: your state has specific assessment methodologies required by statute. Assessments must be based on comparable sales within specific timeframes. You can request the comparable properties they used. The framework is your state’s property tax code and assessment regulations. Once you know it, you can audit whether they followed their own methodology.

The pattern: institutions count on you not knowing which rulebook governs them. Once you identify it, you can check whether they followed it.

Principle 4: Cross-reference multiple authority sources to find violations hiding in the gaps

Violations often hide between documents. A hospital can bill a procedure code correctly according to CPT code definitions, but violate CMS bundling rules. A service can meet the criteria in one section of your insurance policy but fail requirements buried in a different appendix. A debt collector can follow FDCPA rules but violate your state’s shorter statute of limitations.

The reason these violations persist is that cross-referencing multiple authority sources is nearly impossible for humans to do comprehensively. You’d need to hold dozens of pages of technical requirements in your head simultaneously, checking for conflicts across documents that weren’t designed to be read together.

AI is exceptionally good at this. Multi-document pattern recognition that takes a human hours or requires expert knowledge takes Claude minutes.

The hospital bill had violations that only appeared when checking CPT codes against CMS bundling rules AND the Medicare Physician Fee Schedule AND appropriate setting restrictions. Any single document would have made the billing look legitimate. The violations existed in the gaps—procedures that were individually valid but couldn’t legally be billed together, or codes that were appropriate for an inpatient setting but couldn’t be used for the four-hour emergency department visit that actually happened.

The brother-in-law’s prompt was something like: “I have CPT codes [list]. Cross-reference these against current CMS bundling requirements. Check whether these codes can be billed separately or must be bundled. Check the Medicare Physician Fee Schedule for appropriate reimbursement rates. Check whether the setting—emergency department, four-hour visit—affects billing restrictions. Identify any conflicts or violations.”

Claude checked all of them simultaneously. It found that code X bundles codes Y and Z. It found that codes were billed at rates exceeding Medicare schedules. It found that certain procedures couldn’t be billed for emergency department settings. The violations were hiding in the cross-references.

Property tax callout: Your assessment jumps 40%. You suspect it’s wrong but don’t know where to look. Your state has assessment methodology statutes, comparable sales requirements, and assessment ratio requirements. Ask Claude: “Cross-reference my property assessment against [state] assessment methodology statutes, comparable sales data for properties at [addresses] sold between [dates], and required assessment ratios. Identify any methodological violations or deviations from comparable market values.” Claude will check your assessment against all three authority sources simultaneously. You might find they used comparables outside the required timeframe (violates statute), used inappropriate adjustment factors (violates methodology), or your assessment ratio is 20% higher than comparable properties (violates uniformity requirements).

Insurance denial callout: Your claim for a procedure gets denied as “not medically necessary.” Your policy has coverage criteria. Your state has laws about medical necessity determinations. Clinical practice guidelines establish evidence-based standards. Ask Claude: “My policy covers [procedure] when [criteria]. My state requires carriers to follow [statute] for medical necessity determinations. Check whether my medical record meets policy criteria. Check whether the clinical practice guideline for [condition] supports coverage. Check whether the denial letter complies with state requirements for coverage denials.” Claude cross-references all three. You might find your medical record meets all policy criteria (policy violation), the applicable clinical guideline supports your treatment (medical necessity violation), and their denial letter didn’t include required appeal rights (statute violation). Three violations hiding across three different documents.

Debt collection callout: You get a collection notice for a seven-year-old credit card debt. FDCPA requires certain disclosures. Your state has a four-year statute of limitations for written contracts. Ask Claude: “Cross-reference this collection notice against FDCPA disclosure requirements under 15 U.S.C. § 1692g. Check [state] statute of limitations for credit card debt. Check the date of last activity on the account. Identify any FDCPA violations or statute of limitations issues.” Claude might find the notice didn’t include required FDCPA disclosures (federal violation) AND the debt is past your state’s statute of limitations (state law violation, makes debt legally uncollectible). Two violations across two different authority frameworks that debt collectors bet you won’t cross-reference.

This is where AI’s value is most non-obvious. Most people think of AI as good at explaining things or drafting text. The underrated capability is cross-document pattern recognition at scale. Use it. Don’t check just one authority source—check all of them simultaneously and find where your situation violates multiple requirements that weren’t meant to be read together.

Principle 5: Find categorical violations, not marginal disputes

Don’t argue that prices seem high or treatment seems unfair. Find where they broke rules that aren’t negotiable.

The hospital bill included $31 for a single low-dose aspirin. You could argue that’s absurd compared to the $8 bottle of 1,000 at CVS. That’s a marginal dispute about pricing philosophy. The hospital will talk about overhead and regulatory burden and you’ll just trade assertions.

Instead, Claude identified that the hospital billed a master procedure code alongside all its component parts—over $100,000 in charges Medicare bundling rules explicitly prohibit billing separately. That’s not a pricing dispute. That’s a categorical violation. Either they billed bundled codes or they didn’t. Either Medicare rules prohibit it or they don’t.

Categorical violations are binary. The institution either followed the rule or broke it. There’s no room for “well, our costs are high” or “that’s our policy.” They violated documented standards. They can’t defend that.

Funeral home callout: A funeral home requires you to buy a casket from them. You could argue their caskets are overpriced. Or you cite FTC Funeral Rule 16 CFR 453.4(b)(1) which explicitly prohibits requiring consumers to purchase funeral goods from any particular provider. That’s categorical. They either required it or they didn’t. The regulation either prohibits it or it doesn’t. No negotiating margin.

Debt collection callout: A collector calls you at 7:30 AM on a Tuesday. You could say it’s too early and annoying. Or you cite FDCPA 15 U.S.C. § 1692c(a)(1) which prohibits calls before 8 AM. That’s categorical. Either they called before 8 AM or they didn’t. The statute either prohibits it or it doesn’t.

The search isn’t “what feels wrong about this?” It’s “where did they violate explicit rules?” Feelings give you intuition about where to investigate. Documented violations give you leverage.

Principle 6: Establish objective anchors from authority

Your negotiating position needs a number the other side can’t call unreasonable. Find the authoritative standard that establishes it.

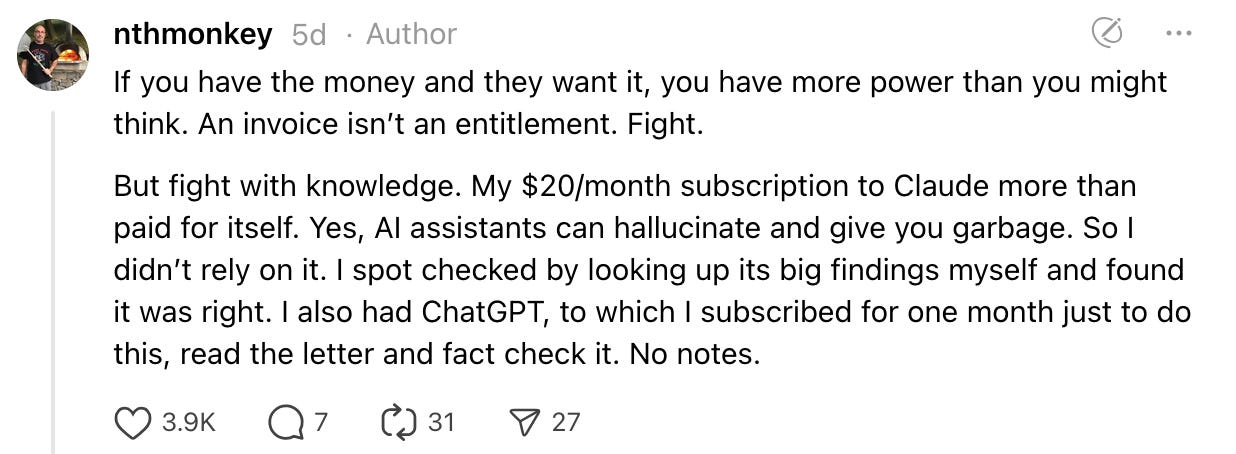

The hospital bill investigation calculated what Medicare would have reimbursed for the legitimate procedures: $32,500. That became the offer. Not “we can only afford $40k” or “this seems like it should be $30k.” The Medicare reimbursement rate.

Why does this work? Because hospitals accept Medicare patients profitably at those rates. They can’t argue Medicare reimbursement is unreasonably low without admitting their Medicare business loses money. The Medicare rate is the revealed preference for what these procedures cost in the market.

This pattern works across domains. Find the published standard, the regulatory benchmark, the documented market rate. Make that your position.

Property tax callout: Your assessed value is $500k but comparable sales in your neighborhood averaged $420k over the relevant period. Your position isn’t “I think it should be lower.” Your position is “comparable sales data from [list properties] averaged $420k. State assessment regulations require valuation based on comparable market sales. My assessment should reflect actual market value of $420k.”

Insurance claim callout: They denied your procedure saying it’s not medically necessary. Your policy says they cover “medically necessary services as determined by generally accepted medical standards.” Your state requires carriers to use evidence-based clinical guidelines. You find that the clinical guideline they’re required to use says your condition meets criteria for coverage. Your position isn’t “my doctor says I need this.” Your position is “Coverage determination must follow evidence-based clinical guidelines per state statute [X]. The applicable guideline [cite] states [criteria]. My medical record documents [criteria met]. Denial contradicts required clinical standards.”

The objective anchor does two things: it gives you a defensible position based on authoritative standards, and it makes them defend why they deviated from those standards.

Principle 7: Verification isn’t optional—you’re building a case

In normal AI use, directional accuracy is often good enough. If Claude gets some details wrong explaining a concept but the overall thrust is right, that’s acceptable.

In adversarial contexts, you’re making factual claims someone will check. If you cite regulations incorrectly, you’ve signaled you don’t know what you’re talking about. If your claimed violations don’t exist, you’ve given them ammunition. There’s no middle ground. Either your documented violations are real or they aren’t.

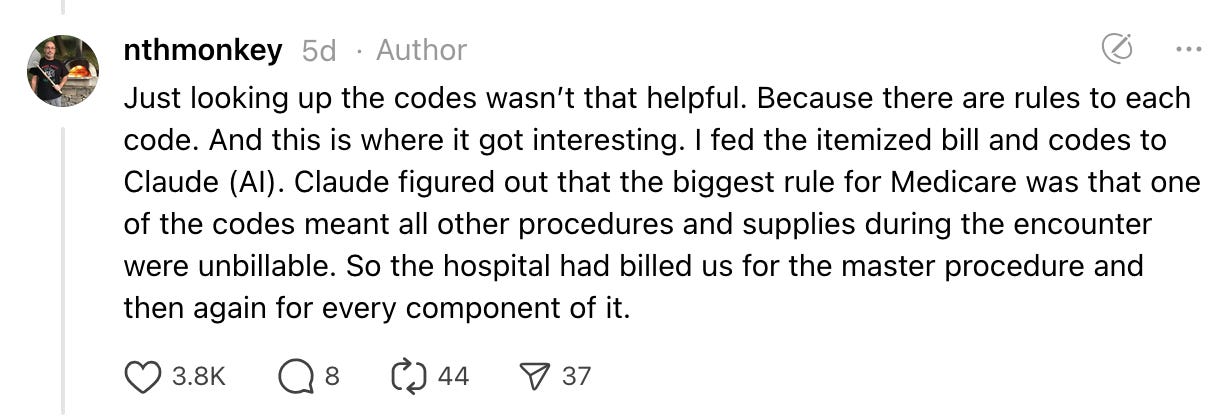

The hospital bill investigation included verification: spot-checking Claude’s findings against actual CMS regulations for the major violations, then having ChatGPT fact-check the complete dispute letter for citation accuracy. That verification is what made the investigation reliable enough to base threats on.

The workflow: Claude identifies potential violations → you verify the top 3 findings against source documents → second AI fact-checks the final letter → you send it.

Yes, you can have AI fact-check! It doesn’t remove your responsibility to give a final check, but it’s very helpful.

Verification callout for debt: Claude tells you a debt is past statute of limitations in your state. Before you send a letter asserting that, you verify: look up your state’s statute yourself, confirm which type of debt this is (written contract, oral contract, open-ended account), verify the date of last activity. If you’re wrong and you send a letter saying “this debt is time-barred,” you’ve potentially confirmed the debt exists and restarted the clock. Verification isn’t paranoia—it’s avoiding self-inflicted wounds.

Verification callout for billing: Claude identifies a Medicare bundling violation. Before you threaten to report it, you verify: read the actual CMS bundling rules for those specific codes, check the current year’s Medicare Physician Fee Schedule, confirm the codes were billed on the same date. If you cite violations that don’t exist, you’ve told them you can be safely ignored.

You’re using AI to do investigation that would take institutional expertise. But you’re verifying the findings that carry risk. AI collapses the cost of investigation while leaving you in control of quality.

Principle 8: Signal sophistication, not emotion

Institutions triage disputes based on whether you’re a threat or a mark. They’re not evaluating moral merit. They’re evaluating: will fighting this person cost more than settling?

If your dispute letter reads like an angry consumer venting, they know you’re not a threat. You’re upset but you don’t understand how their system works. They can safely ignore you or give you a token discount.

If your letter reads like institutional correspondence—specific regulatory citations, documented violations, professional language, measured escalation threats—they know you understand the system well enough to cause real problems. They need to take you seriously.

You’re not being dishonest. You’re matching the register institutions use for serious business. They don’t respond to emotion—they respond to documented leverage and credible consequences.

What sophistication looks like: “We have identified violations of Medicare bundling regulations for CPT codes [list]. CMS guidelines prohibit separate billing for procedures bundled under code [X]. We have documented inappropriate billing totaling $[amount]. Our settlement offer reflects Medicare reimbursement rates for legitimately billable procedures. If this is not resolved within 30 days, we are prepared to file complaints with [oversight body] and pursue legal remedies.”

What emotion looks like: “Your bill is outrageous and you should be ashamed of yourselves for trying to take advantage of a widow. This is unfair and we demand you reduce it to a reasonable amount immediately.”

Same facts, completely different signal about what kind of fight you’re bringing.

Signaling callout for IEPs: Not: “My child needs more support and you’re not giving it to him.” Instead: “The evaluation documents deficits in [areas] with standard scores of [numbers]. IDEA requires services sufficient to provide meaningful educational benefit. Comparable students in this district receive [services cited from district data]. Your proposed services do not meet FAPE standards established in [relevant case law]. We request an IEP meeting to revise the service plan to align with documented needs and legal requirements.”

Signaling callout for insurance: Not: “My doctor says I need this and you denied it for no good reason.” Instead: “Your denial cites lack of medical necessity. Our policy defines medical necessity as [quote policy language]. Clinical evidence shows [cite evidence]. Your state’s claims handling statute [cite] requires external review for coverage disputes. We are requesting formal external review and will pursue bad faith litigation if the denial is not reconsidered.”

You’re using AI to draft language that matches institutional register even if you don’t normally write that way. The prompt isn’t “tell them this is unfair.” It’s “draft formal dispute correspondence citing these violations with appropriate professional cadence and credible escalation consequences.”

Principle 9: Control the frame

Institutions try to categorize disputes in ways that preserve their legitimacy and limit your leverage. They want you to be asking for mercy, not demanding compliance.

When the hospital offered charity assistance, they were trying to frame the negotiation as: widow can’t afford bill, hospital provides charitable discount, bill remains legitimate. That framing gives them moral authority and maintains pricing fiction.

The brother-in-law refused: “We’re not looking for charity, we’re negotiating price based on documented billing violations.” Same negotiation, completely different power dynamic. They’re not being generous to someone in need—they’re defending why they violated Medicare billing rules.

Frame control callout for debt: Collector frames it as “you owe this debt, how much can you pay?” That frame accepts the debt is valid and legitimate. Reframe: “I dispute this debt’s validity. It appears time-barred under [state] statute of limitations with a [X]-year limit on [debt type]. I’m invoking my FDCPA rights to debt validation. Provide documentation of debt validity, amount, and legal collectibility.” You shifted from “how much can I pay” to “prove you have a right to collect anything.”

Frame control callout for insurance: Insurer frames denial as “this isn’t covered under your policy.” That frame assumes they applied policy correctly and you’re asking them to make an exception. Reframe: “Your denial appears to misapply policy terms. Policy section [X] covers [services] when [conditions]. My claim meets stated conditions. Additionally, your denial letter does not comply with state requirements for coverage denials under [statute]. I’m requesting formal reconsideration and external review.” You shifted from “please make exception” to “you misapplied your own policy and violated claims handling requirements.”

The frame determines what kind of power you can bring. If you accept their frame, you’re negotiating from weakness. If you establish your frame, they’re defending from weakness.

Principle 10: Staged escalation with diagnostic responses

Don’t think of disputes as binary—either you fight or you don’t. Think of them as staged investigation where each response gives you information about whether to continue.

Stage 1 is informed pushback. You’ve investigated, identified potential violations, drafted professional correspondence. You send it. This is low-cost—hours of work, no legal fees yet.

What happens next tells you everything:

They fold immediately: The hospital came back at $37k from $195k after the first letter. That’s surrender. They can’t defend the billing and they know it. Take the win. You don’t need escalation because they’ve conceded the core issue.

When institutions fold fast on high-stakes disputes, it means you caught them doing something they can’t defend publicly or legally.

They counter reasonably: They come back with “we disagree on interpretation of X but we’ll settle at Y.” This is negotiation territory. They’re not conceding wrongdoing but they’re not digging in.

This is judgment time. Is the gap between their offer and your position worth continued fighting? The brother-in-law split the difference between his $32.5k position and their $37k counter. Both sides negotiated, both sides moved, done. No lawyer needed.

They ignore you: Two possibilities. Either they’re gambling you won’t follow through, or your position was weak.

Be honest about your investigation. Did you verify those violations thoroughly? If yes and you’re confident, ignoring is a bluff. If you didn’t verify, they might have checked and you’re wrong.

Ignoring also varies by amount. They might ignore $500 because fighting costs more than settling. They rarely ignore $195k with documented violations. If they’re ignoring high-stakes with documentation, either your position has holes or they’re betting you don’t follow through.

They escalate legally: They send a letter from their counsel. This is “we’re going to fight” signal.

Now evaluate: is your position defensible? If you identified clear regulatory violations you verified, their escalation might be posturing. If you’re in ambiguous territory—disputed contract interpretation, unclear facts—their escalation means you need professional help.

The decision isn’t “they lawyered up so I need a lawyer.” It’s “is my position strong enough to fight with documentation, or did they escalate because I’m wrong?”

They try to change the frame: Like the hospital suggesting charity. They can’t defend on substance so they’re trying to make it about something else.

This is often a tell that your investigation is solid. Stay on the documented issues. Don’t let them reframe.

Each response is diagnostic. You’re not committed to full litigation from the first letter. You’re testing whether documented violations give you leverage, then deciding based on their reaction.

When you need professional help

AI changes when you need professional help, not whether you ever need it.

The calculation used to be: hire a professional to investigate OR don’t fight. Investigation required expertise most people don’t have. Medical billing advocates charge $2,000-5,000 to review complex bills. Lawyers charge $300-500/hour for initial investigation. Those costs made fighting prohibitively expensive for many disputes.

AI enables: investigate yourself, decide about professional help based on what investigation reveals.

You can now decode documents, identify governing frameworks, audit for violations, calculate benchmarks yourself. That investigation used to cost thousands. Now it costs hours of your time.

What you can’t get from AI: judgment about how ambiguous rules will be interpreted, procedural knowledge for formal proceedings, and reputation-based signaling that gets taken seriously.

The decision framework:

Self-advocacy territory if:

- Dispute involves documented standards you can verify (regulations, published fee schedules, clear contract terms)

- Violations are categorical, not interpretive (they either did X or didn’t)

- Amount justifies your time but not thousands in legal fees

- You’re willing to verify key findings thoroughly

- Initial pushback is low-risk (a letter won’t make things worse)

- You have clear escalation thresholds

Get professional help if:

- The law is ambiguous and requires interpretation

- Success depends on how a judge/arbitrator will rule on competing arguments

- Opposing side has counsel and you’re in formal proceedings

- Procedural requirements are complex (court filings, administrative appeals)

- Cost of being wrong exceeds cost of expertise

- You’re not willing/able to verify AI findings

- Time is critical and you lack runway to investigate

Use AI to prepare for professional help if:

- You need expertise but want to understand issues first

- Investigation reveals you need a lawyer but you want to reduce education time

- You want to fact-check whether professional advice is competent

The hospital bill was pure self-advocacy territory: clear regulatory standards, categorical violations, verifiable findings, high amount justified time, initial letter was low-risk. If it had gone to litigation, that’s when professional help was needed—not for investigation but for litigation strategy and procedural expertise.

Professional help callout: You’re in contract dispute over whether “reasonable efforts” means spending $50k or $500k on marketing. That’s ambiguous law requiring judgment about how courts interpret vague terms. Investigation with AI helps you understand the arguments, but judgment about likelihood of prevailing requires someone who knows how courts in your jurisdiction rule on similar clauses. Get professional help.

Self-advocacy callout: Debt collector threatens to garnish your wages for a 7-year-old debt. Your state has 4-year statute of limitations. Date of last activity was 7 years ago. That’s categorical—debt is time-barred, threats are FDCPA violations. Investigation with AI identifies this, you verify statute and date, you send validation letter asserting time-barred status. Low-risk self-advocacy.

The shift: you’re not asking “can I do this without a lawyer?” You’re asking “can I do investigation without paying for it, then decide about lawyers based on what investigation reveals?”

What you’re actually learning

This isn’t about hospital bills or debt collection specifically. It’s about building capacity to fight institutional power asymmetry wherever you encounter it.

The pattern: Institutions construct complexity to enable price discrimination. They charge different amounts to different people based not on costs but on the customer’s ability to navigate their systems. They count on individuals lacking institutional knowledge, being intimidated by technical language, not having time to investigate, and not knowing how to signal sophistication.

AI gives you investigation capacity at institutional scale. You can decode technical documents, identify governing frameworks, audit for categorical violations, calculate benchmarks, draft professional correspondence, and verify findings—without subject matter expertise.

But only if you understand you’re conducting an investigation, not asking for advice. Only if you verify instead of trusting blindly. Only if you know how to signal sophistication. Only if you understand framing determines power. Only if you read responses diagnostically and know when you’re outmatched.

The hospital bill went from $195k to $32.5k because someone understood these principles. The methodology works wherever institutions use complexity as a moat.

Investigate, don’t just ask. Document leverage, not just complaints. Signal competence, not emotion. Control the frame. Verify what matters. Stage escalation based on responses. Know when you need help.

That’s adversarial prompting. And that’s how you fight back.

I make this Substack thanks to readers like you! Learn about all my Substack tiers here

Subscribed